Andy Powers-A Professional who cares..About YOU!

The United States Constitution, The Bill of Rights and Amendments 11-27

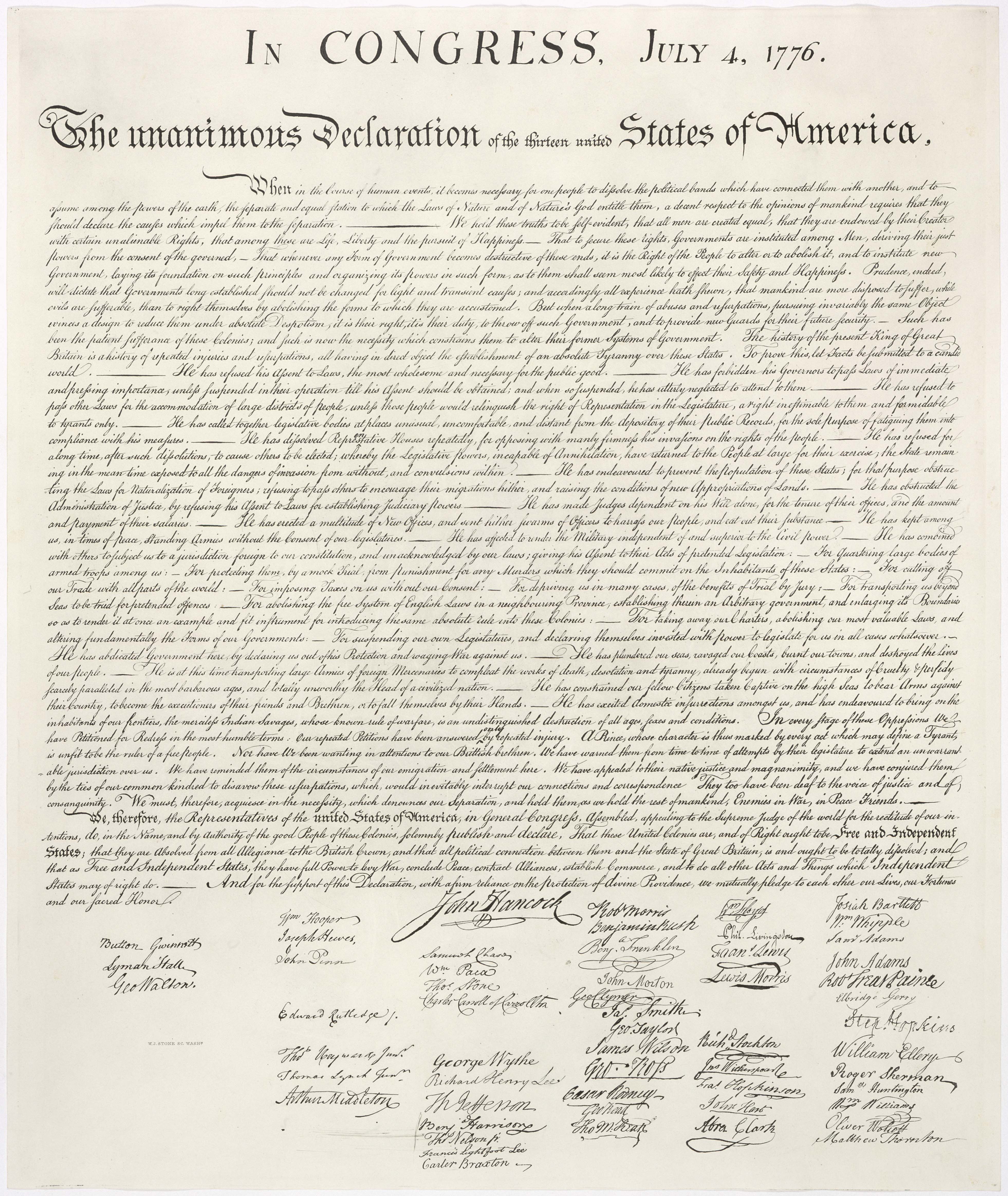

I often wonder just how many natural born citizens of the United States of America have actually read and understand the seven Articles of the U.S. Constitution as amended by Amendments 1-10, also known as the Bill of Rights, along with the 16 subsequent amendments to the Constitution, for although ignorance of the law is no excuse for conviction of violation, ignorance of the founding principles of our Republic including the Constitution and its Amendments which set forth the powers of federal government and our rights as citizens is an open invitation for an unintended powerful and potentially tyrannical national government and the progressive voluntary deterioration of our rights.

In the event that you or someone you love has not had the opportunity to read our governing ";laws of the land", as imposed principally on government, I have found an internet site that provides copies of the original constitution with italicized amendments that I encourage you to peruse, print and share. Just click the links below.

THE BILL OF RIGHTS (Amendments 1-10)